You Don’t Need To Be Rich To Start Investing

Have you ever heard about Warren Buffett, the global investment oracle? If you have, you probably already know that he made his billions through investing in the share market. Warren Buffett aside, millions of other ordinary people worldwide have built wealth from the ground up through investing.

Investing isn’t only for the wealthy and it’s not just for the brainiacs, and you’ll be surprised to know it’s something you can do with just $5. Despite what you may think, investing is accessible to everyone in Australia. The ability to purchase a share does not discriminate based on education, gender or the size of your bank balance.

You can get a perfectly respectable return without too much thought at all — go check out the magic of ETFs! For most people investing isn’t about the charts, numbers and inside scoop, it’s about finding a simple, cost-effective and diversified solution that you can put in place and monitor, making the occasional adjustments.

Your first investment doesn’t need to be the next big stock that your roommate told you about or some insane leveraged product. Throw showing off out the window, because no one will care down the track that you found something more exciting than them to invest in, and your brokerage account will thank you. Now that’s not to say that once you’re confident with the basics you don’t step up your game and start incorporating different products or analysing your own stocks.

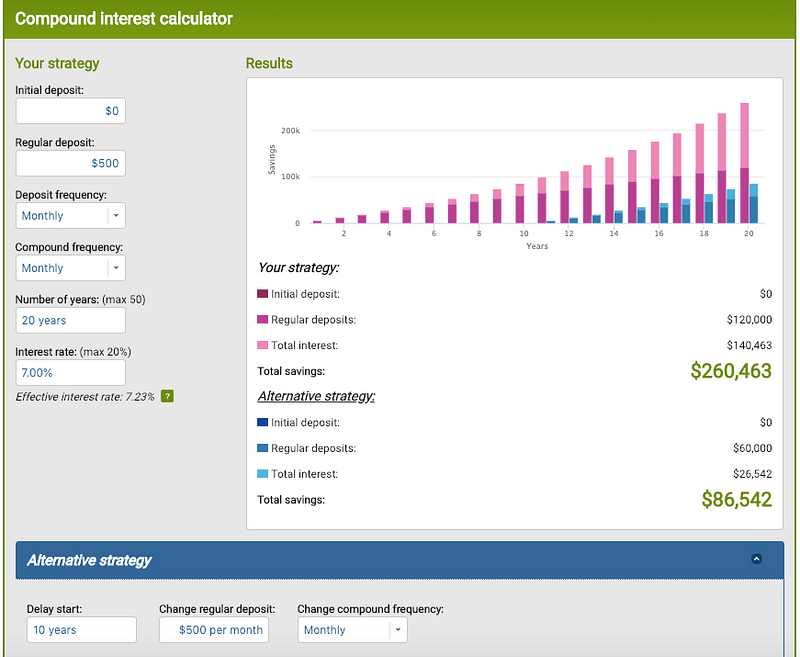

As my friend Owen from Rask Finance puts it, investing is about little bits, lots of times. And it works! Having a small starting balance and committing to a regular contribution plan, is leaps and bounds beyond waiting years until you have what you believe is a big enough chunk of cash. Just look at the numbers if you don’t believe me — and I certainly encourage you to visit the ASIC MoneySmart Compound Interest Calculator to play around with this for yourself!

Now we’ve covered the benefits of starting small and starting early, let’s talk about the options you have when getting started with smaller balances.

Micro-Investing

This is probably the quickest way to get started and dip your toe in the water, as you’ll only need $5. Whether you set up a regular contribution plan in your Raiz account or start buying small parcels of shares with Stake, there are numerous Australian companies offering quick and easy ways to start investing. Some examples to get you started are:

Direct Investing

Another great option is investing directly in the shares or ETFs themselves through a brokerage account. Brokers have brought down their minimum trade amounts to as low as $500, but bear in mind you’ll be paying brokerage of around $10 to $20 for each trade. We’ve even got a handy guide on investing in shares over here!

There are a few companies that provide broker comparisons (though the lists aren’t always exhaustive) — check out CANSTAR and Finder and the ASX list. You’ll need to choose an option that suits your needs and is fairly easy to use — but keep in mind that the price of brokerage varies by provider and should be something you keep in mind.

Managed Investments

One final option which is starting to appear is getting started with a managed fund. Over the last few years, I’ve seen multiple fund providers start to offer investors the ability to get started with $1,000 if they agree to set up a monthly contribution plan. Considering you generally need much higher balances to enter managed investment products, this may be an option to consider. For more information on choosing a managed fund — MoneySmart has got you covered.

I hope that this gives you a few different options to consider if you’re ready to start investing — and has shown you that you most certainly do not need to be rich to start investing right now! As always feel free to drop me an email at howtomoneyaus@gmail.com if you have any questions or comments!

Kate — HTM Editor & Host

Kate Campbell is the founder of How To Money. Kate created HTM from a passion to help young Australians start talking about money, and share the resources she finds along her financial education journey. This led Kate to start her own journey to financial independence a few years back and she now works in the Australian financial services industry.

Want to learn more about money and personal finance? Check out our article archive, the How To Money Podcast and the Australian Finance Podcast. Catch us on Twitter @HowToMoneyAUS and Instagram on @HowToMoneyAUS.

Important Information

The information on this blog and website is of a general and educational nature only. It does not take into account your individual financial situation, objectives or needs. You should consider your own financial position and requirements before making a decision, as we are not an advisory service. We recommend you consult a licensed financial adviser in order to assist you. The information is based on assumptions or market conditions which can change without notice, and this will impact the accuracy of the information provided. This website and blog occasionally provide links to third-party sites, aimed at helping you gather the information required to make an informed decision — we may receive payment for these referrals.