A Guide to Buying Shares in Australia

So you’re just about ready to start investing; you understand diversification, your risk tolerance level and have a bit of an idea on how shares and ETFs work, but you’ve just realised that you’re not actually sure how exactly to buy this ETF or share you’re really keen on.

Luckily for you, I’ve had a few goes at setting up trading accounts through a handful of different platforms, and have bought and sold shares and ETFs for the last few years (including quite a few idiotic decisions when I first got started)! So grab a chair and let me take you through the steps required to buy a share in Australia.

1) Choose a Brokerage Platform

If you want to buy and sell shares in Australia you’re going to need to sign up for a brokerage account (aka share trading account), and like most things, there are many different options to choose from. What is a brokerage account you ask? A brokerage account allows you to buy and sell shares through the brokerage firm which facilitates the orders (and acts as a middleman to connect buyers and sellers). The brokerage firm does this for a fee, which is called the brokerage fee.

There are a few companies that provide broker comparisons (though the lists aren’t always exhaustive) — check out CANSTAR and Finder and the ASX list. You’ll need to choose an option that suits your needs and is fairly easy to use — but keep in mind that the price of brokerage varies by provider and should be something you keep in mind. It may also be good to consider what level of customer support, research & data and overseas markets you need when choosing a provider, as they all have varying level of access and functionality.

For the purpose of this guide, I’ll be using CommSec, which is the share trading platform owned and operated by the Commonwealth Bank of Australia (CBA). This is one of the largest and most commonly used share trading platforms in Australia, which I have personally used. Please bear in mind that this is not a recommendation to use CommSec, so please do your research and choose the best platform for your needs.

2) Open a Brokerage Account

Once you’ve chosen the share trading platform that you want to use, it’s now time to set up your brokerage account. If you already bank with the broker you’re using, it may speed up the process of setting up your account. You’ll then be asked a range of questions such as what account type you’re looking to open.

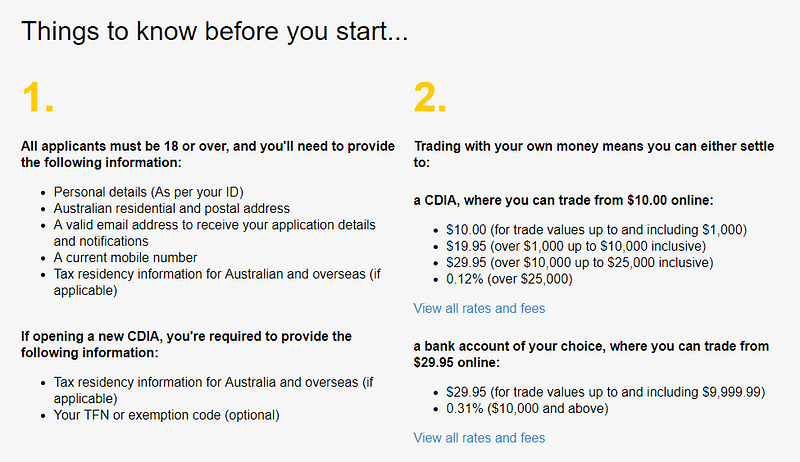

CommSec also provides you with a handy list of the information you’ll require going through the account opening process, as they will need to ID you and collect relevant information which they are required to have on file. They’ve also highlighted the fees and the costs associated with opening a bank account with them for the purposes of buying and selling shares or linking your own existing bank account.

The questions that follow are fairly standard and are quite similar to opening up a bank account. Once everything is submitted your application will be reviewed and the broker will submit your details to CHESS (Clearing House Electronic Subregister System), which is Australia’s settlement system for trades made through the ASX.

CHESS will issue you a unique Holder Identification Number (HIN) — which will consolidate all of your holdings made through the same brokerage account. You will receive a CHESS holding statement for every purchase or sale you make independently through CHESS (click here for an example).

3) Fund your Brokerage Account

Whether you linked your existing bank account to your brokerage account or set up a new one, it’s important to have funds in your account before placing a trade. Be careful to make sure that your funds arrive prior to any trades you make settling, because your broker may penalise you for dishonouring your purchase.

4) Place a Buy Order

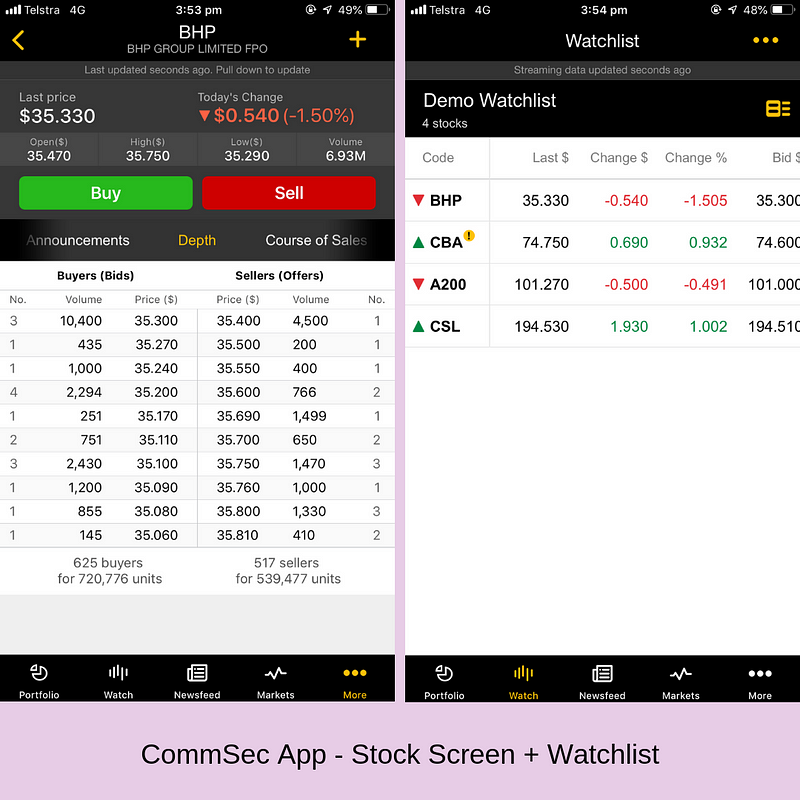

Once your account is set up and you’ve got your HIN, you’re ready to place your trade. CommSec and many other brokers have phone apps where you can do this on the go, but it might be a good idea to place your very first trade on the computer (so you don’t add an extra zero to your quantity required)!

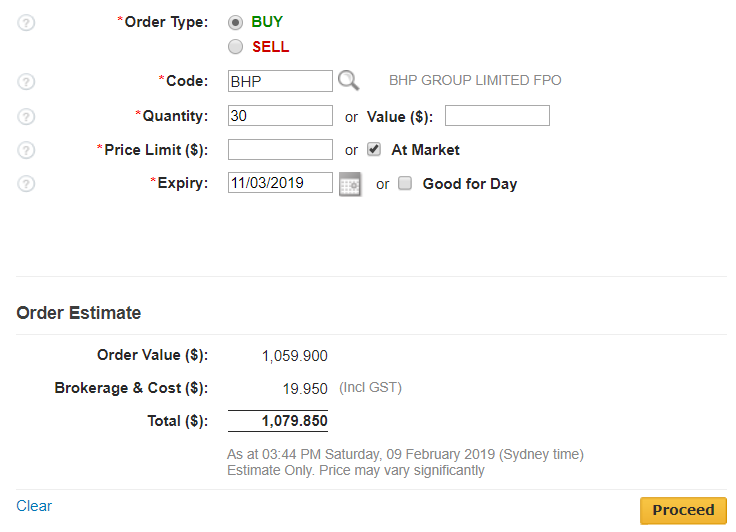

If you know what you want to purchase, it’s time to place your buy order. Let’s say I want to buy 100 BHP shares. I then need to decide if I want to place my order ‘at market’ or put on a price limit. If you place an ‘at market’ order the broker will attempt to execute your trade at the best currently available price, however, if you place a buy order with a price limit, it instructs your broker to execute the trade only if the price is below the amount you specify.

You will also need to decide if you want your trade to only be good for a day, or set an expiry date. Setting an expiry date means that if the broker cannot fill your order, the order will stay on your account waiting to be filled unit the date specified. CommSec will also provide you with an order estimate based on the information you have provided.

Once you click proceed you will be provided with a screen confirming the details of your order, which you should carefully review prior to submitting the order. It’s not the brokers’ fault if you order 300 BHP shares rather than 30! Once you submit your order the broker will attempt to action your instruction when trading in the security is open. The ASX is typically open from 10 am till 4 pm during business days but does close on certain public holidays.

5) Maintain Your Share Holdings

The final piece of the puzzle here is keeping track of your assets, so your grandkids don’t discover worthless holding statements hidden in a draw 50 years down the track (true story)! When you purchase the securities you’ll receive a contract note from your broker detailing the trade, and CHESS will post you out a holding statement. It’s worth putting all the documents in a secure location, so you can keep track of everything down the road.

Another key component will be setting up your account with the relevant share registry for the company. This will allow you to change your Dividend Reinvestment Plan (DRP) settings and access tax documents, among other things moving forward. Finally keep track of your shares on the go through your brokers’ app, or by using a portfolio management tool.

So there you go — hopefully you’re now feeling ready to buy your first share, but if not feel free to send me an email at howtomoneyaus@gmail.com.

Kate — HTM Editor & Host

Kate Campbell is the founder of How To Money. Kate created HTM from a passion to help young Australians start talking about money, and share the resources she finds along her financial education journey. This led Kate to start her own journey to financial independence a few years back and she now works in the Australian financial services industry.

Want to learn more about money and personal finance? Check out our article archive, the How To Money Podcast and the Australian Finance Podcast. Catch us on Twitter @HowToMoneyAUS and Instagram on @HowToMoneyAUS.

Important Information

The information on this blog and website is of a general and educational nature only. It does not take into account your individual financial situation, objectives or needs. You should consider your own financial position and requirements before making a decision, as we are not an advisory service. We recommend you consult a licensed financial adviser in order to assist you. The information is based on assumptions or market conditions which can change without notice, and this will impact the accuracy of the information provided. This website and blog occasionally provide links to third-party sites, aimed at helping you gather the information required to make an informed decision — we may receive payment for these referrals.